In the fast-paced world of marketing and branding, companies continually seek innovative ways to capture the attention and loyalty of their target audience. Among the many strategies, one often overlooked but immensely powerful phenomenon is the “Mere Exposure Effect.” This subtle psychological principle can be harnessed to transform your brand into a household name.

What is the Mere Exposure Effect?

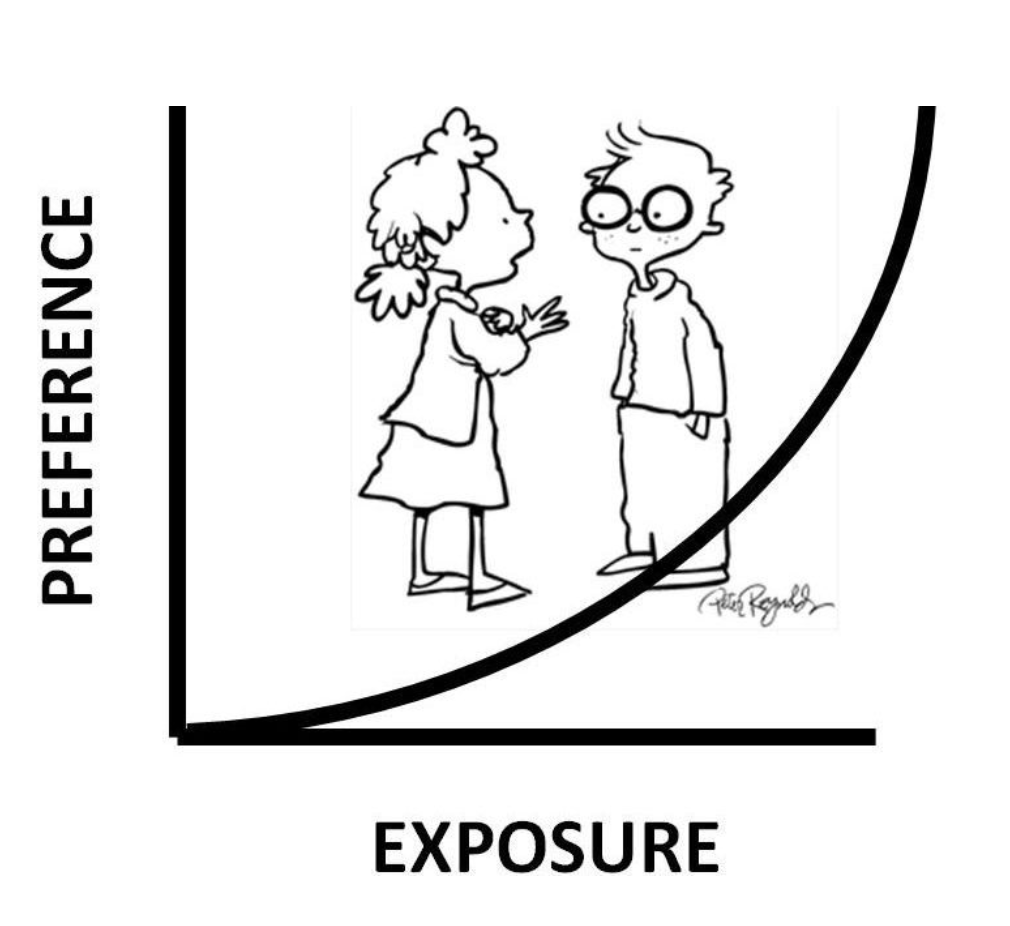

The Mere Exposure Effect is a psychological concept that suggests people tend to develop a preference for things they are exposed to repeatedly. In essence, familiarity breeds liking. When individuals encounter something regularly, whether it’s a logo, a jingle, or a brand color, they become more inclined to view it favorably.

Building Brand Trust

Developing trust with your audience is a fundamental goal in branding. Trust translates into customer loyalty and long-term success. The Mere Exposure Effect plays a crucial role in building trust by making your brand appear reliable and familiar.

Imagine seeing a brand’s logo repeatedly in various contexts, from social media to billboards, and even on the product packaging. Each encounter reinforces the brand’s presence and subtly communicates that it’s dependable and worthy of attention.

Creating Brand Recognition

Brand recognition is a priceless asset. When consumers can instantly identify your brand among a sea of options, you’re on the right track. The Mere Exposure Effect is your ally in this quest. By consistently exposing your audience to your brand elements, such as your logo, tagline, or specific color scheme, you enhance recognition.

Think of iconic brands like Coca-Cola or McDonald’s. Their logos and color schemes are so ingrained in our minds that they are instantly recognizable. This level of recognition doesn’t happen overnight but is nurtured through repeated exposure over time.

Increasing Favorable Perceptions

The more consumers encounter your brand, the more positively they perceive it. This can lead to a halo effect where they transfer their positive feelings about one aspect of your brand to other aspects, even those they haven’t encountered as frequently.

For example, if someone has had repeated positive interactions with your customer service, they might extend their positive feelings to your product quality, even if they haven’t used your products before. The Mere Exposure Effect amplifies these favorable perceptions.

Utilizing the Mere Exposure Effect in Brand Development

To harness the Mere Exposure Effect effectively, consider the following strategies:

- Consistency: Ensure that your branding elements (logo, colors, fonts) are consistent across all platforms and materials.

- Repetition: Repeatedly expose your audience to your branding elements. This includes social media, advertising, packaging, and even email signatures.

- Variety in Context: Present your brand in different contexts and settings to reach a broader audience.

- Quality Matters: While repetition is essential, the quality of your brand’s touchpoints is equally vital. Ensure every interaction is a positive one.

In conclusion, the Mere Exposure Effect is a silent superpower in brand development. It’s not a magic wand for instant success but rather a steady force that, over time, can transform your brand into one that’s trusted, recognized, and loved by your target audience. By embracing this psychological principle, you can strategically shape the perceptions of your brand and nurture long-lasting customer relationships.

By: Edan Gelt. Leave a review for me at: https://certifiedconsumerreviews.com/edan-gelt/